Commercial Studies Specimen Paper 2023 Sec-B Solved for ICSE Class-10. Step by step solutions as council prescribe guideline of model sample question paper. Student can achieve their goal in next upcoming exam of council. Visit official website CISCE for detail information about ICSE Board Class-10..

Solutions of ICSE Class 10 Commercial Studies Specimen Paper 2023 Sec-B

| Board | ICSE |

| Class | 10th (x) |

| Subject | Commercial Studies |

| Topic | Specimen Paper Solved |

| Syllabus | Revised Syllabus |

| Session | 2022-23 |

| Sec-B | Descriptive |

Warning :- before viewing solution view Question Paper.

ICSE 2023 EXAMINATION SPECIMEN QUESTION PAPER

Commercial Studies Sec-B

Maximum Marks: 80

- Time allowed: Two hours

- Answers to this Paper must be written on the paper provided separately.

- You will not be allowed to write during the first 15 minutes.

- This time is to be spent in reading the question paper.

- The time given at the head of this Paper is the time allowed for writing the answers.

- Attempt all questions from Section A and any four questions from Section B.

- The intended marks for questions or parts of questions are given in brackets [ ].

ICSE Class 10 Sec-B Commercial Studies Specimen Paper 2023

(Attempt any four questions from this Section.)

Question 5:

(i) Discuss five objectives of pricing in detail.

(ii) Explain any five functions of Central Bank.

Answer: (i) Five main objectives of pricing are:

(a) Achieving a Target Return on Investments:

A target return refers to the future value, or profit, that an investor expects from their investment. Target return is different from other pricing models because it takes into account the time-value of money. Typically, investors work backward from the expected target return to reach a current price.

(b) Price Stability:

Price stability is a goal of monetary and fiscal policy aiming to support sustainable rates of economic activity. Policy is set to maintain a very low rate of inflation or deflation.

(c) Achieving Market Share:

To win market share and dominate an industry, a company can consider buying its competition. Such a move actually offers multiple strategies to increase market share in one action. With an acquisition, a company takes a competitor out of the market and assumes its market share. It captures its customer loyalty.

(d) Prevention of Competition:

It means any improper alteration of a competition to win money through sports betting or to ensure that a bettor (who may have offered a bribe) wins their bet.

(e) Increased Profits:

Every business can improve its profitability. Sometimes a single factor can significantly increase profitability, but for most businesses increasing profitability means implementing a number of small improvements gradually.

(ii) five functions of Central Bank.

- Central banks can be defined as state-owned entities tasked with formulating monetary policy, acting as banks to the Government and other Bankers, serving as the Lender of Last Resort, and overseeing the domestic banking system with financial supply and rate of interest.

- The core roles of central banks are to assist the government in maintaining macroeconomic stability and encouraging financial stability in the monetary system.

- Regulating the note issue, functioning as the bankers’ bank, operating as even the government’s bank, selling and purchasing currencies to affect the exchange rate, and interfacing with foreign central banks and international organisations are other roles that central banks do.

- There are varying degrees of the Government’s Control over Central Bank.

- A central bank plays a vital role in the regulation of the financial sector.

Question 6:

(i) Briefly discuss five characteristics of a capital market.

(ii) Write short notes on:

(a) Intellectual Property fraud

(b) Private warehouse

Answer:

(i) five characteristics of a capital market.

- The capital market links savers with the borrowers of funds. It routes money from savers to entrepreneurial borrowers.

- Capital Market is a market for medium and long-term financial instruments. It helps in raising long-term funds. Through this market, Corporates, industrial Organizations, financial institutions and so on get access to long-term funds from both domestic and foreign markets.

- Capital Market doesn’t deal with short-term financial instruments like Banker’s Acceptance, Certificate of Deposits and Commercial Paper.

- Presence of intermediaries: Capital Market operates with the help of intermediaries like brokers, underwriters, merchant bankers, sub-brokers, collection bankers and so on. These intermediaries are important elements of a capital market.

- Determinant of rate of capital formation: Capital Market is a determinant of the rate of capital formation in an economy as it mobilizes funds. Capital Formation is the net addition to the existing stock of an economy’s capital.

- Capital Markets are regulated by government rules and regulations: Capital Market operates freely. However, it is regulated by government rules, regulations and policies. For example, BSE and NSE are regulated by SEBI, a government body.

(ii) (a) Intellectual Property fraud:

Intellectual property fraud is when someone steals something that is protected by copyright, trademark, patent, or trade secret laws. The term “intellectual property fraud” covers a wide range of behaviors.

(b) Private warehouse:

A private warehouse is a warehouse that is privately owned by wholesalers, distributors, or manufacturers. Large retail and online marketplaces also have their own privately-owned warehouses.

Question 7:

(i) Explain the Utility of Budgets.

(ii) Discuss five functions of an advertising agency.

Answer:

(i) A budget helps create financial stability. By tracking expenses and following a plan, a budget makes it easier to pay bills on time, build an emergency fund, and save for major expenses such as a car or home. Overall, a budget puts a person on stronger financial footing for both the day-to-day and the long term.

(ii) five functions of an advertising agency.

1. Advertising budget

- Advertising agency helps an advertiser to prepare his ad budget. It helps him to use his budget economically and make the best use of it.

- Without a proper advertising budget, there is a risk of client’s funds getting wasted or lost.

2. Coordination: Advertising agency brings a good coordination between the advertiser, itself, media and distributors.

3. Sales promotion: Advertising agency performs sales promotion. It helps an advertiser to introduce sales promotion measures for the dealers and consumers. This helps to increase the sales of the product.

4. Public relations: Advertising agency does the public relations (PR) work for its clients. It increases the goodwill between its clients and other parties like consumers, employees, middlemen, shareholders, etc. It also maintains good relations between the client and media owner.

5. Non-advertising functions

- Advertising agency also performs many non-advertising functions:

- It fixes the prices of the product, It determines the discounts, It designs the product, It also designs its package, trademarks, labels, etc.

Question 8:

(i) Explain any five modules of ERP.

(ii) Describe any five techniques of sales promotion.

Answer:

(i) Five modules of ERP.

1. Supply Chain Management: Maximizing supply chain management efficiency is an essential business process that needs to be done. Supply chain management is typically complicated due to the considerable number of moving parts. This is where ERP modules and ERP solutions come into play.

2. Financial Management: Financial management modules are one of, if not the most, helpful tools you can implement in your ERP program. With finances being the backbone of your business, an effective financial management ERP tool will work with every branch in your company. For example, the ability to use real-time sales data to calculate revenue.

3. Inventory Management : Inventory management ERP software works closely with supply chain management, acting as a somewhat lite version. The basic principle of inventory management is that a business needs to know how much stock they have. This goes beyond simple data analysis and order fulfillment. The information could be used to accurately allocate space for incoming inventory as well.

4. CRM: A strong customer relationship is vital to every business, which is why implementing an ERP CRM solution is extremely beneficial. Using a CRM helps you better manage the sales funnel. Keeping track of your customers, sales and leads becomes a simple matter when you’re using the right CRM tool.

5. Human Resources: Human resources is a module that deals with every department in your company. Because it contains valuable information and processes, it’s a highly recommended module implementation.

(ii) five techniques of sales promotion.

letters, catalogues, point of purchase displays, customer service programmes, demonstrations, free samples, discounts, contests, sweepstakes, premiums and coupons are the commonly employed methods of sales promotion.

Question 9:

(i) State two advantages and three disadvantages of internal recruitment.

(ii) Write short notes on: (a) RTGS (b) Principle of Contribution (in insurance)

Answer:

(i) Advantages of internal recruitment:

1. Familiarity with the candidate : One of the main advantages of internal recruitment is that the candidates are already known to hiring managers and should be the right cultural fit for the company, no matter what role they move into.

2. Improved employee learning curve: An existing employee should be familiar with the inner workings of the company – the operations, processes and procedures that are unique to the business.

Disadvantages of internal recruitment:

1. Negative impact on other employees: Internal recruitment may have a negative effect on other employees, particularly those who applied for the role and weren’t successful.

2. Reduced talent pool: If a company chooses internal recruitment, the pool of possible candidates is greatly reduced. In some cases, an existing employee may be the best fit, but in others an external perspective might be preferable.

3. Bias concerns: Internal recruitment can cause bias concerns within an organisation. This is because it’s harder for hiring managers to be fair and objective when choosing candidates that are already known to them.

(ii) (a) RTGS:

Real Time Gross Settlement (RTGS) is an electronic form of funds transfer where the transmission takes place on a real time basis. Over 60 countries worldwide use RTGS systems. RTGS systems are typically run by the central bank of a country. Often, these systems are integral components of the country economy.

(b) Principle of Contribution (in insurance):

Contribution principle applies when the insured takes more than one insurance policy for the same subject matter. It states the same thing as in the principle of indemnity, i.e. the insured cannot make a profit by claiming the loss of one subject matter from different policies or companies.

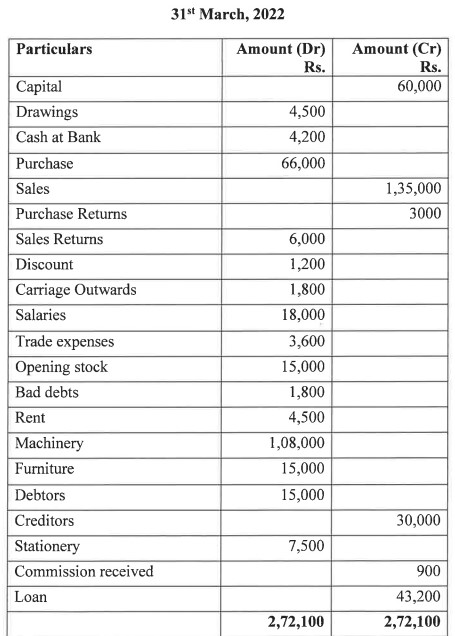

Question 10: Prepare a Trading, Profit and Loss account of Mr. A. Awasthi for the year ending on 31st March, 2022 and a Balance Sheet as on 31 March, 2022.

Closing stock on 31° March, 2022 was valued at Rs. 78,000.

Answer: Update soon

–: End of Commercial Studies Specimen Paper 2023 Sec-B for ICSE Class 10 :—

Return to : ICSE Specimen Paper 2023 Solved

–: visit also :–

- ICSE Class-10 Textbook Solutions Syllabus Solved Paper Notes

- School will be closed on These Dates in August, Check Total Holidays

- High Salary Top Courses After 12th Science for Boys / Girls

- Which School Board is Better for IIT JEE and NEET Preparation?

- Which Entrance Exam Is Easier To Crack – NEET, IIT, JEE?.

- CISCE 2023 Exam: Clue of Board Paper Standard

- ICSE Board Paper Class-10 Solved Previous Year Question

Thanks