Compound Interest Class 8 RS Aggarwal Exe-8D Goyal Brothers ICSE Maths Solutions Ch-8. We provide step by step Solutions of council prescribe textbook / publication to develop skill and confidence. Visit official Website CISCE for detail information about ICSE Board Class-8 Mathematics.

Compound Interest Class 8 RS Aggarwal Exe-8D Goyal Brothers ICSE Maths Solutions Ch-8

| Board | ICSE |

| Publications | Goyal Brothers Prakashan |

| Subject | Maths |

| Class | 8th |

| writer | RS Aggarwal |

| Book Name | Foundation |

| Ch-8 | Simple Interest and Compound Interest |

| Exe-8D | When Compounded Half Yearly |

| Academic Session | 2024-2025 |

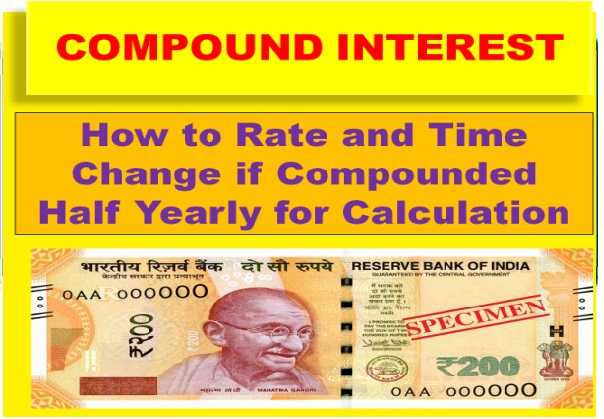

Formula When Compounded Half Yearly

The formula for calculation of compound interest for half yearly is A = p(1 + {r/2}/100)2t . Here in this formula ‘A’ is the final amount, ‘p’ is the original principal, and ‘t’ is the time in years.

In case of half yearly rate should be divide by 2 while time must be multiplied by 2 and then calculate simple using compound interest formula

Exercise- 8D

( Compound Interest Class 8 RS Aggarwal Exe-8D Goyal Brothers ICSE Maths Solutions Ch-8 )

Que-1: Find the amount and the compound interest on Rs120000 at 8% per annum for 1 year, compounded half-yearly.

Sol: Given that, P = Rs. 120000

R = 8%

T = 1 year

if compounded half-yearly T = 2, R = 4%

We know that, CI = P[(1+(R/100))^T − 1]

⇒ CI = 120000[(1+(4/100))² − 1]

⇒ CI = 120000[((104×104)/(100×100)) − 1]

⇒ CI = 120000[(1.0816−1)]

= 120000(0.0816)

= 9792

∴ CI = Rs. 9792

A = P+C.I.

= 120000+9792

= 129792.

Que-2: Find the amount and the compound interest on Rs32500 for 1 year; at 12% per annum, compounded half-yearly.

Sol: Since the rate of interest is 12% per annum, therefore, the rate of interest half yearly = 1 / 2 of 12% = 6 %.

Principal ( P ) = Rs 32,500

Time = 1 year = 2 half yearly

We know that, CI = P[(1+(R/100))^T − 1]

⇒ CI = 32500[(1+(6/100))² − 1]

⇒ CI = 32500[((106×106)/(100×100)) − 1]

⇒ CI = 32500 (1.1236-1)

⇒ CI = 32500 × 0.1236

⇒ CI = 4017

A = P+C.I.

= 32500+4017

= 36517.

Que-3: Calculate the amount and the compound interest on Rs24000 for 1*(1/2) years at 10% per annum, compounded half-yearly.

Sol: Interest compounded half yearly

⟹ r = (10%)/2 = 5% per interest period.

No. of interest period (n) = 2(3/2) = 3

P = Rs.24000

CI = P[(1+(r/100))^n − 1]

CI = 24000[(1+(10/100))³ − 1]

= 3783

Hence, the compound interest = Rs.3,783

A = P+C.I.

= 24000+3783

= 27783.

Que-4: Calculate the amount and the compound interest on Rs10000 for 6 months at 12% per annum, compounded quarterly.

Sol: Time = 6 months

Principal = Rs. 10,000

Rate of Interest = 12% p.a. compounded quarterly.

A = P{1 + (R/100)}^n

Effective rate of interest = R/4 = 12/4 = 3% —-(Because interest is compounded quarterly)

and n = 6/3 = 2 quarters —-(Because interest is compounded quarterly)

Now,

⇒ 10,000 × {1 + (3/100)}^2

⇒ 10,000 × (103/100) × (103/100)

⇒ Rs. 10,609

C.I. = A-P

= 10609 – 10000

= 609

Que-5: Calculate the amount and the compound interest on Rs15625 for 9 months at 16% per annum, compounded quarterly.

Sol: Principal = Rs.15625

Time = 9 months = 3 Quarters

Rate of interest = 16 % per annum = 4 % per quarter

To find out the Compound Interest, we first need to the find out the Amount.

Amount = 15625×(1+(4/100))^3

= 15625×(104/100)×(104/100)×(104/100)

= 15625×(26/25)×(26/25)×(26/25)

= 17576

C.I. = 17576−15625 = Rs.1951

Que-6: Calculate the amount and the compound interest on Rs2560000 for 1 years at 10% per annum, compounded quarterly.

Sol: Principal = 25,60,000

Time = 1 X 4 = 4 YEAR ( Given Quarterly )

Rate = 10/4 ( Same given quarterly )

Amount = Principal ( 1 + Rate/100 )⁴

= 25,60,000 × ( 1+(10/100)

= 25,60,000 × ( 410/400)⁴

= 25,60,000 × (410/400) × (410/400) × (410/400) × (410/400)

= 256 × (41/4) × (41/4) × (41/4) × (41/4)

= 256 × (1681/16) × (1681/16)

= 1681 ×1681

Amount = 28,25,761 RS

C.I. = A – P

= 28,25,716 – 25,60,000

= 2,65,761 RS

–: Compound Interest Class 8 RS Aggarwal Exe-8D Goyal Brothers ICSE Maths Solutions Ch-8 :–

Return to :- ICSE Class -8 RS Aggarwal Goyal Brothers Math Solutions

Thanks

Please share with yours friends if you find it helpful