ICSE Economics Applications 2018 Paper Solved Class-10 Previous Year Questions for practice so that student of class 10th ICSE can achieve their goals in next exam of council. . Hence by better practice of Solved Question Paper of Previous Year including 2018 is very helpful for ICSE student.

By the practice of ICSE Economics Applications Paper Previous Year you can get the idea of solving. Try Also other year for practice. Visit official website CISCE for detail information about ICSE Board Class-10.

ICSE Economics Applications 2018 Paper Solved Class-10 Previous Year Questions

- Answers to this Paper must be written on the paper provided separately.

- You will not be allowed to write during the first 15 minutes.

- This time is to be spent in reading the Question Paper.

- The time given at the head of this Paper is the time allowed for writing the answers.

- Section A is compulsory. Attempt any four questions from Section B.

- The intended marks for questions or parts of questions are given in brackets [ ].

Previous Year Questions ICSE Economics Applications 2018 Paper Solved Class-10

Section – A [40 Marks]

(Attempt all questions from this Section)

Question 1 :-

(a) List any two causes for the low efficiency of labour in India. [2]

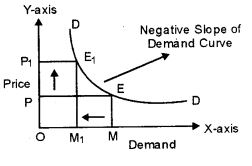

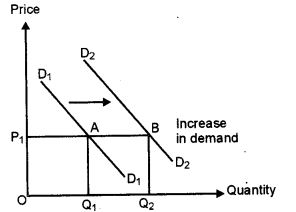

(b) Draw a neat labelled diagram of a demand curve. [2]

(c) Give any two reasons as to why a country needs a Central Bank. [2]

(d) Out of the following capital used in the cotton textile industry, classify the following as fixed or circulating capital [2]

(i) Cotton yams

(ii) Dyes

(iii) Power

(iv) Weaving machines

(e) What are progressive taxes ? Give an example. [2]

Answer 1 :-

(a)

(i) Lack of skill.

(ii) Lack of regular training.

(b)

(c)

(i) To control and regulate the monetary structure.

(ii) To stabilise the banking system.

(d)

(i) Circulating

(ii) Circulating

(iii) Circulating

(iv) Fixed

(e)

A type of tax under which rate of tax changes with change in income. For example, income tax.

Question 2 :- (ICSE Economics Applications 2018)

(a) Capital is a passive factor of production.’ Justify the statement. [2]

(b) Which bank is referred to as a Banker’s Bank ? Why is it called so ? [2]

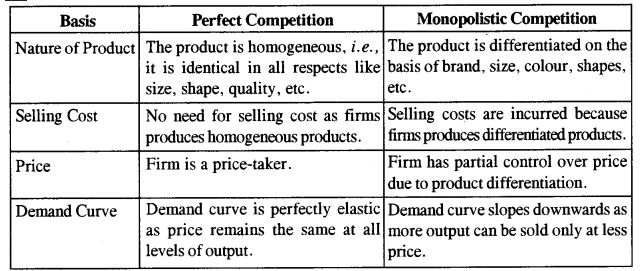

(c) State any two differences between Monopolistic competition and Perfect competition. [2]

(d) Which section of the society gains during inflation ? Why ?

(e) Explain two ways by which the government can reduce income inequalities in a developing economy.

Answer 2 :-

(a)

Capital is a passive factor of production as it need human factor to produce. For example, to run any machine labour is required.

(b)

Central Bank (RBI in case of India).

Central Bank regulate and supervise the Commercial Banks. Being the apex bank, the Central Bank (RBI) acts as the banker too their banks.

As the banker to banks, the Central Bank functions in three capacities :

(i) Custodian of Cash Reserves : All the commercial banks are required to keep a certain proportion of their deposits known as Cash Reserve Ratio or CRR with the Central Bank. In this way, Central Bank acts as a custodian of cash reserves of Commercial banks.

(ii) Lender of the Last Resort:

- The Central Bank acts as the lender of the last resort.

- When commercial banks fail to meet their financial requirements from other sources, they can approach the Central Bank which provide them loan and advances as lender of the last resort.

(iii) Clearing House : As Central Bank holds the cash reserves of all the commercial banks, it becomes easier and more convenient for it to act as their clearing house.

(c)

(d)

Inflation has a deep impact on the distribution of income and wealth in a country. It results in the redistribution of income and wealth because prices of all the factors of production do not increase in the same proportion. Generally, inflation always inflicts more injury on the fixed income groups like workers, teachers, pensioners, interest and rent earners etc.

because their incomes do not increase as fast as the prices. On the other hand, flexible income groups such as businessmen, traders merchants etc. suffer less injury due to windfall profits that arise because prices rise faster than the cost of production

(e)

(i) By following progressive taxation system.

(ii) By increasing government expenditure in backward regions

Question 3 :-

(a) Mention two ways in which an entrepreneur is different from labour. [2]

(b) Differentiate between current and savings deposits. [2]

(c) Briefly explain any two impacts of shifting cultivation on the ecosystem. [2]

(d) Name a market where selling cost is not required. Give a reason for your answer. [21

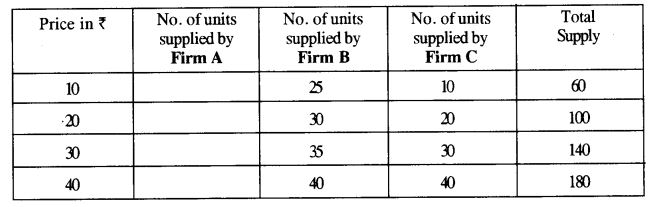

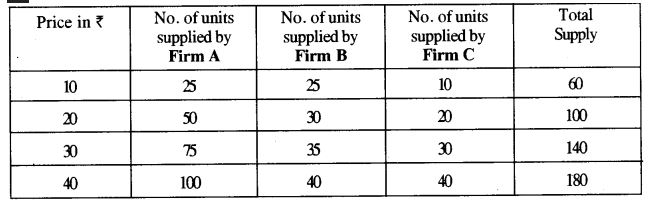

(e) Given below is the market supply schedule of a commodity.The individual supply schedules of firms B and C are given, prepare the individual schedule for Firm A : [2]

Answer 3 :-

(a)

(i) Labour is a hired factor of production whereas entrepreneur hires other factors of production.

(ii) Labour earns wages whereas entrepreneur earns profits.

(b)

Demand deposit or current accounts are generally held by business firms or institutions to carry out their day to day transactions without any limit on there transactions whereas saving deposits are generally held by common public with a limit on number of free withdrawals.

(c)

(i) Forests are burnt leading to reduction in Forest area.

(ii) Area is cleared off, by removing the trees and vegetation.

(d)

Under perfect competition, firms produce homogeneous products which are similar in size, colour, packing, quality, etc. So, firms need to spend money on product differentiation.

(e)

Question 4 :- (ICSE Economics Applications 2018)

Define the following terms :

(a) Price elasticity of Demand [2]

(b) Proportional taxation [2]

(c) Capital formation [2]

(d) Labour [2]

(e) Inflation [2]

Answer 4 :-

(a) It is the degree of responsiveness of demand for a commodity with reference to change in price of the commodity.

(b) If the tax is imposed at the same rate on the persons of different income level, it is called proportional tax.

(c) It refers to the increase in the stock of real capital in an economy during an accounting period.

(d) The aggregate of all human physical and mental effort used in creation of goods & services.

(e) Inflation : Rapidly or persistent rise in price.

Previous Year Questions ICSE Economics Applications 2018 Paper Solved Class-10

Section – B [40 Marks]

(Attempt any four from this Section)

Question 5 :-

(a)

(i) What is considered as capital in economics ? [7]

(ii) Discuss any three characteristics of capital.

(b) Explain how the following factors affect the supply of a commodity : [8]

(i) State of technology.

(ii) Price of factors of production.

(iii) Goals of the firm.

(iv) Future price expectations.

Answer 5 :-

(a)

(i) Capital include all goods or financial assets as well as tangible factors used in production or accumulating more wealth.

(ii) 1. Man-made Factor : Capital is not a gift of nature. So it is not a primary or natural factor, it is made by man in capital goods industry. It is secondary as well as an artificial factor of production.

2. Productive Factor : Capital helps in increasing level of productivity and speed of production.

3. Elastic Supply : Supply of capital depends upon capital formation process. Capital formation depends upon savings and investment. By accelerating capital formation, capital supply can be increased. But it is a long term process.

(b)

(i) State of Technology : State of technology also affects supply of the commodity. Improvement in the technique of production reduces cost of production. Consequently, more of the commodity is supplied at its existing price.

(ii) Price of Factors of Production : Supply of a commodity is also affected by the price of factors used for the production of the commodity. If the factor price decreases, cost of production also reduces. Accordingly, more of the commodity is supplied at its existing price. Conversely, if the factor price increases cost of production also increases. In such a situation less of the commodity is supplied at its existing price.

(iii) Goals of the Firm : If goal of the firm is to maximise profits, more quantity of the commodity will be offered at a higher price. On the other hand, if goal of the firm is to maximise sales (or maximise output or employment) more will be supplied even at the same price.

(iv) Future Price Expectations : If the producer expects price of the commodity to rise in the near future, current supply of the commodity will reduce. If, on the other hand, fall in the price is expected, current supply will increase.

Question 6 :- (ICSE Economics Applications 2018)

(a)

(i) Name any two industries where division of labour is possible. [7]

(ii) Explain any three demerits of division of labour.

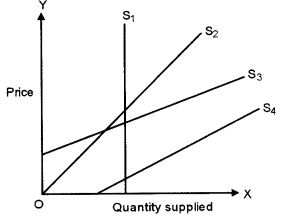

(b) Identify and define the degree of price elasticity of supply from the diagram for the supply curves S1, S2, S3, S4. [8]

Answer 6 :-

(a)

(1) Two Industries where division of labour is possible are:

- Food production

- Motor factories

(2) Demerits of Division of Labour are:

- Increased dependence on machines : As division of labour increases there will be an increased use of machines. Almost all the workers work on different types of machines. It is very difficult for them to work without machines. Thus, division of labour increases the dependence on machines.

- Monotony of work : The labours had to perform a similar work again and again which lead to boredom. The job becomes monotonous in nature. It causes a mental fatigue which deteriorates the quality of work .

- Lack of responsibility : Under division of labour production passes through several stages, so it seems difficult to fix responsibility.

(b)

(1) Perfectly Inelastic Supply : When there is no change in quantity supplied in response to any

price change, the supply is said to be perfectly or completely inelastic.

Here, ∈s = 0

(ii) Unit Elastic Supply: When proportionate change in supply equals the proportionate change in price, the supply is said to be unit elastic.

Here, ∈s = 1

(iii) Elastic Supply: When change in quantity supplied is more than proportionate change in own price, the supply is said to be elastic.

Here, ∈s > 1

(iv) Inelastic Supply : When the change in quantity supplied is less than proportionate change in own price, supply is said to be inelastic.

Here, ∈s < 1 .

Question 7 :-

(a)

(i) What happens to the demand curve when there is an increase in demand ? [7]

(ii) Discuss three instances when demand will increase.

(b) Explain any four ways by which Public Sector Enterprises play a dominant role in an economy. [8]

Answer 7 :-

(a)

(i) Whenever there is increase in demand, the demand curve shift towards left.

(ii)

(a) Increase in price of substitute goods : Substitute goods are the goods which can be used in place of one another for example tea and coffee. When price of substitute good (say, coffee) rises, demand for the given commodity (say, tea) will rise.

(b) Decrease in price of complementary goods : When price of complementary good (petrol) falls, demand for the given commodity (car) rises.

(c) Increase in income (Normal Goods) : With increase in income, demand for normal good rises.

(b)

1. Development of infrastructure : Development of infrastructure comprising transport, power, communication, basic industries, etc. is a precondition of growth. Expenditure on the development of infrastructure is known as Social Overhead Costs. Pace of industrial development cannot be accelerated without their establishment. Their development requires huge capital investment, which cannot be mobilised by the private sector. Moreover, these projects do not promise high profits. The private entrepreneurs would therefore be reluctant to undertake them.

2. Development of backward areas : The goal of achieving a reduction in economic inequality between regions becomes easy to reach, if industries are setup in the backward areas. But the profit seeking private industrialists often are not enthusiastic enough to set up industry in the backward regions. The government, therefore, finds it necessary to start industrial production in these areas on its own.

3. Basic facilities: There are a large number of activities which are the primary responsibilities of the government. The government must spend on these. Providing health and education facilities for all is one example. Running proper schools and providing quality education, particularly elementary education, is the duty of the government. India’s size of illiterate population is one of the largest in the world.

4. Other problems : There are many other problems like malnourishment, high infant mortality rate, unsafe drinking water, lack of housing facilities, etc. which need special attention. These problems can be solved only with the help of government.

Question 8 :- (ICSE Economics Applications 2018)

(a) Who controls the credit supply in an economy ? What is this policy called ? Explain how the following can control inflation in an economy. [7]

(i) Cash Reserve Ratio

(ii) Statutory Liquidity Ratio

(b)

(i) Why can a monopolist charge different prices in different markets ? [8]

(ii) Explain any three features of monopoly.

Answer 8 :-

(a) Reserve Bank of India controls the credit supply in an economy. This policy is called Monetary Policy.

(i) Cash Reserve Ratio (CRR) : It refers to the minimum amount of funds that a commercial bank has to maintain with the Reserve Bank of India in the form of deposits. For example, suppose the total assets of a bank are worth ?200 crores and the minimum cash reserve ratio is 10%.

Then the amount that the Commercial Bank has to maintain with RBI is ?20 crores. An increase in CRR reduces the lending ability of the Commercial Banks. If this ratio rises to 20%, then the reserve with RBI increases to ?40 crores.Thus, less money will be left with the commercial bank for lending. This will eventually lead to considerable decrease in the money supply.

(ii) Statutory Liquidity Ratio (SLR) : SLR is concerned with maintaining the minimum reserve of assets with RBI, whereas the cash reserve ratio is concerned with maintaining cash balance (reserve) with RBI. So,SLR is defined as the minimum percentage of assets to be maintained in the form of either fixed or liquid assets with RBI. The flow of credit is reduced by increasing this liquidity ratio and vice-versa. A rise in SLR will restrict the banks to pump money in the economy, thereby contributing towards decrease in money supply.

(b)

(i) A monopolist can charge different prices in different markets due to product differentiation which leads to lack of perfect knowledge. Buyers and sellers do not have perfect knowledge about the market conditions. Selling costs create artificial superiority in the minds of the consumers and it becomes very difficult for a consumer to evaluate different products available in the market. As a result, a particular product (although highly priced) is preferred by the consumers even if other less priced products are of same quality.

(ii)

1. One seller but large number of buyers : In the monopoly market, there is only one seller but large number of buyers. This single seller may be in the form of an individual owner or a partnership or a joint stock company. Being the only seller, a monopolist faces no competition from other firms.

Not only that there is no difference between firm and industry in this form of market structure. Because of this the market demand curve is also the demand curve for monopolist. But the number of buyers is large in this market. An individual buyer has no influence on the market price. The buyers have no option but to purchase the commodity from the monopolist or go without the product.

2. No close substitute : In the monopoly market, monopolist produces goods that have no close substitutes. This is an essential condition for a firm to be called monopolistic. The goods which can be easily used for each other and are available at nearly the same price are called close substitutes.

If there are some other firms which are producing close substitutes for the product in question there will be competition between them and then the firm cannot be said to have monopoly. Due to this particular feature, cross elasticity of demand between the product of the monopolist and the product of any other producer must be nil or very small.

3. Strong barriers to the entry of new firm : Another important feature of the monopoly market is that there are. barriers or restrictions on the entry of new firms on the market. The barriers which prevent the firms to enter the industry may be economic in nature or else of institutional and artificial in nature. These restrictions may take several forms such as patent rights, copy rights, government laws and economies of scale.

Question 9 :-

(a) What is privatization ? Explain the following arguments favouring privatization : [7]

(i) Greater flexibility in decision making.

(ii) Better utilization of resources.

(iii) Greater employment opportunities.

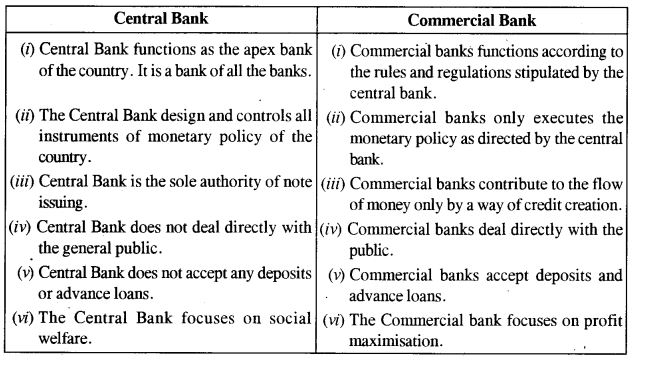

(b) Explain clearly four differences between a Central Bank and a Commercial Bank. [8]

Answer 9 :-

(a)

Privatisation is the general process of involving the private sector in the ownership or operation of a state owned enterprises.

(i) Greater Flexibility in decision making : Private sector is owned and controlled by private individual or individuals. All the major economic decision i.e. how to produce, what to produce, for whom to produce are taken by the individual keeping in mind the profit factor.

(ii) Better utilisation of resources : Under private sector resources are fully and efficiently utilised keeping in mind cost and profits.

(iii) Greater employment opportunities : Private sector in most of the developing nations has grown at a very fast rate. In last few decades more than 40% of the work force of developing nation is working for private sector.

Question 10 :- (ICSE Economics Applications 2018)

Read the extract and answer the following :

Indirect taxes have become an important source of development funds in developing countries. Many developing economies that have adopted economic planning use indirect taxes as important source of funds. These taxes are found to be better suited in developing countries because they have much wider coverage as compared to direct taxes. Both rich and poor pay indirect taxes in the form of commodity price.

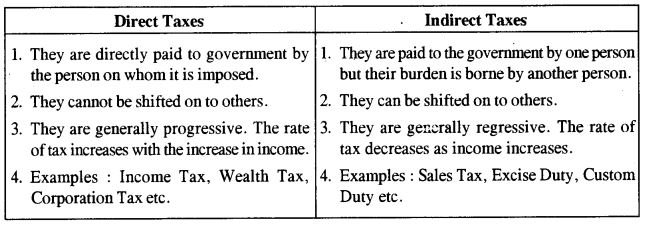

(i) What are indirect taxes ? [2]

(ii) Mention three important differences between direct and indirect taxes. [3]

(iii) Classify the following into direct and indirect taxes. [2]

1. Custom duty

2. Professional tax

3 . Income tax .

4. Entertainment tax

(iv) Give two reasons why indirect taxes are important in developing countries. [4]

(v) Explain clearly how indirect taxes can be both regressive and progressive. [4]

Answer 10 :-

(i) Indirect taxes are the taxes which are imposed on goods and services. There taxes affect the income and property of individuals and companies through their consumption expenditure.

(ii)

(iii)

1. Indirect tax

2. Direct tax

3. Direct tax

4. Indirect tax

(iv)

(a) Indirect taxes are important source of revenue for the government.

(b) They have a broad coverage.

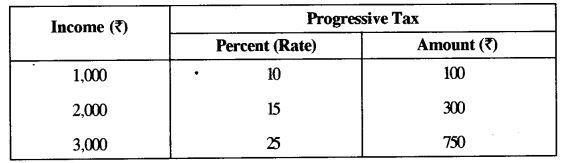

(v) 1. Progressive Tax: If the rate of tax changes with the change in income, it is called Progressive

tax. Hence, the rich should pay more and the poor should pay less.

The Progressive tax is very popular in developing countries.

Table below shows progressive tax.

As shown in table person with income of ₹ 1,000 pays 10 % tax and the persons with income of ₹ 2,000 and ₹ 3,000 pay 15 % and 25 % taxes respectively. Tax rate increases with the increase in income. The progressive tax has the qualities of flexibility, economy, more income earning, reduce income inequality, based on ability to pay. However, this tax has demerits like tendency of evasion, conceal income, arbitrariness, adverse effects on saving and investment.

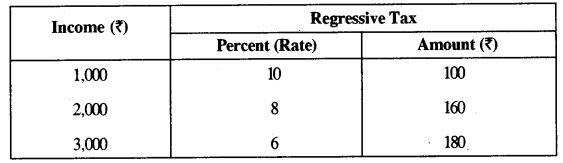

2. Regressive Tax : If high rate of tax is levied to the poor and low rate is levied to the rich it is called regressive tax.

Table below shows regressive tax.

As shown in table tax rate decreases with increase in income. A person with income of ₹ 1,000 pay 10% tax, and the persons with income of ₹ 2,000 and ₹ 3,000 pay 8% and 6% taxes respectively. This tax is quite opposite of progressive tax. The tax rate decreases with increase in income.

Hence, this tax takes decreasing proportion of increasing income. For example, the tax levied on necessary goods is regressive. It taxes more percentage of low income. This tax, therefore, increases income inequality. This tax system makes injustice. So, this tax is impracticable and inappropriate in poor countries.

Thanks

Please Share with Your Friends

Return to — ICSE Board Paper Class-10 Solved Previous Year Question