ISC Economics Semester-2 Solved Specimen / Model / Sample Paper 2022 Class-12 for practice. Step by step solutions of ISC Class-12 specimen model sample paper. During solutions of semester-2 Economics specimen paper we explain with figure , graph, table whenever necessary so that student can achieve their goal in next upcoming exam of council .

ISC Economics Semester-2 Solved Specimen / Model / Sample Paper 2022 Class-12

| Board | ISC |

| Class | 12th (XII) |

| Subject | Economics |

| Topic | Semester-2 ISC Specimen Paper Solved |

| Syllabus | on bifurcated syllabus (after reduction) |

| session | 2021-22 |

| Question Type | Descriptive Type (as prescribe by council) |

| Total question | Total-12 with all parts (Sec A, B and C) |

| Max mark | 40 |

Warning :- before viewing solution view Question Paper

Solved Class-12 for practice Set of Economics Semester-2 ISC Specimen Model Sample Paper

SECTION A – 8 MARKS

Question 1:

(i) Firm A sells flour to firm B for 100/- Firm B sells biscuits to the wholesaler C for 160/- and Firm C sells biscuits to consumers for ` 200/. Hence, the gross value added is:

(a) Rs. 460/-

(b) Rs. 305/-

(c) Rs. 244/-

(d) Rs. 200/-

Answer : (d) Rs. 200/-

(ii) Medium of exchange and measure of value are:

(a) Primary functions of money

(b) Secondary functions of money

(c) Tertiary functions of money

(d) Contingent functions of money

Answer : (a) Primary functions of money

(iii) Aggregate supply is equal to:

(a) C + I

(b) C + S

(c) I + C

(d) S1 + S2

Answer : update soon ………..

(iv) Transfer earning in National income refers to:

(a) transfer of income from one person to another.

(b) income received by selling goods.

(c) unilateral payment received not related to any production.

(d) earning received by offering services.

Answer : (b) income received by selling goods.

(v) A consumer spending on purchase of goods regardless of the income in possession, is an example of _______ consumption.

(vi) _____________ is the creation of new currency to fill the gap between Government revenue and Government expenditure of the country.

(vii) GNP(fc) = GNP(mp) – NDP

(viii) Give one difference between a Direct tax and an Indirect tax

Answer :

| It is levied on income and activities conducted. | It is levied on product or services. |

| The burden of tax cannot be shifted in case of direct tax. | The burden of tax shifted for indirect taxes. |

| It is paid directly by person concerned. | It is paid by one person but he recovers the same from another person i.e. person who actually bear the tax ultimate consumer. |

SECTION B – 12 MARKS

Answer the following questions briefly.

Question 2:

Differentiate between CRR and SLR.

Answer : CRR is the percentage of money, which a bank has to keep with RBI in the form of cash. On the other hand, SLR is the proportion of liquid assets to time and demand liabilities.

Question 3:

Briefly explain two reasons for the adverse Balance of Payments in any economy.

Answer : Update soon …………..

Question 4:

Draw a well labelled diagram of two sector model of circular flow of income including the financial sector.

Answer : Update soon …………..

Question 5:

Complete the following schedule –

Answer : Update soon …………..

Question 6:

(i) Differentiate between Cash Credit and Outright Loans.

Answer : Cash credit is a short-term business loan. It is meant for entrepreneurs wanting to get quick working capital. An overdraft facility, on the other hand, is a long-term financial assistance. It lets you withdraw money from your account even with zero balance.

OR

(ii) How is Devaluation of currency different from Depreciation of currency? Give any two differences.

Answer :

A devaluation occurs when a country makes a conscious decision to lower its exchange rate in a fixed or semi-fixed exchange rate.

A depreciation is when there is a fall in the value of a currency in a floating exchange rate.

Question 7:

What is meant by the following functions of the Central bank:

(i) Clearing house

(ii) Lender of the last resort

Answer :

(i) Clearing house: The Central bank performs the function of clearing house. The cheques of two banks are cleared through their accounts with central bank.

(ii) Lender of the last resort : As the lender of last resort, the central bank is under the obligation to provide funds against securities to the commercial bank as and when needed by them. Thus, the central bank plays the role of guarantor for the commercial banks and maintains a sound and healthy banking system in the economy.

SECTION C – 20 MARKS

Question 8:

(i) What is meant by Equilibrium income? How is it determined by using Saving and Investment approach?

OR

(ii) Discuss the mechanism of investment multiplier with the help of a numerical.

Answer :

(i) The equilibrium level of income refers to when an economy or business has an equal amount of production and market demand. The equilibrium level of income refers to when an economy or business has an equal amount of production and market demand.

The equilibrium level of national income is established at the point where aggregate demand equals aggregate supply.

(ii) Update soon …………..

Question 9:

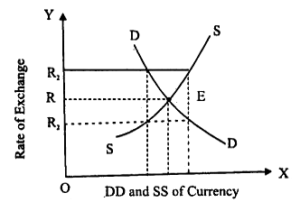

How is the rate of exchange determined in a flexible exchange rate system?

Answer :Under flexible exchange rate system, the exchange rate is determined by the forces of market demand and market supply. Here, the central banks do not intervene in the foreign exchange market.

In the given diagram, demand and supply of currency is measured along OX axis and rate of exchange is measured along OY axis. D is demand curve and S is the supply curve. The demand and supply curves of foreign exchange have intersected at point E where the exchange rate (R) is determined. If the rate of exchange increases from OR to OR1, the supply of foreign currency exceeds its demand causing decrease in rate of exchange. On the other hand, if the exchange rate decreases from OR to OR2, the demand for foreign currency exceeds the supply of foreign currency which leads to increase in rate of exchange later.Read more on Sarthaks.com – https://www.sarthaks.com/632241/how-is-the-exchange-rate-determined-under-a-flexible-exchange-rate-regime

Question 10:

Explain the steps involved in calculating the National income by Income method.

Answer : Update soon …………..

Question 11:

Explain the following methods of redemption of Public Debt:

(i) Debt conversion

(ii) Sinking fund

Answer : Update soon …………..

Question 12:

Read the given extract carefully and answer the following questions.

Mr. X wanted to buy an expensive motorcycle for his son but he did not have sufficient money to buy it. He approached a public sector commercial bank for the loan. The bank asked Mr. X to deposit 20% cash of the loan amount and rest 80% of the loan amount was given by the bank.

(i) Briefly explain a Commercial Bank.

(ii) What is the regulation of consumer credit in selective credit control?

(iii) Name the bank which controls all the commercial banks and financial institutions in the country.

Answer : Update soon …………..

Return to:- Specimen Paper Semester-2 ISC 2022 Class-12 Descriptive Type

thanks

Please share with your ICSE friends

absolute piece of shit solve do not use EVER

something is better than nothing