GST ML Aggarwal Solutions ICSE Class 10 Mathematics Chapter-1 Goods and service Tax . We Provide Step by Step Answer of Chapter-1 GST , with MCQs and Chapter-Test Questions / Problems related Exercise-1 GST for ICSE Class-10 APC Understanding Mathematics . Visit official Website CISCE for detail information about ICSE Board Class-10.

GST ML Aggarwal Solutions ICSE Class 10 APC Understanding Mathematics Chapter-1

-: Select Topics :-

How to Solve GST Problems/Questions / Exercise of ICSE Class-10

Before viewing Answer of Chapter-1 GST of ML Aggarwal Solution.Read the Chapter Carefully then solve all example of your text book. The Chapter 1 GST is new Chapter in ICSE board in place of VAT. For more practice on GST related problems/Questions/Exercise try to solve GST exercise of other famous publications also such as Goyal Brothers Prakshan (RS Aggarwal ICSE) / Concise Selina Publications Mathematics. Get the formula of GST for ICSE Class 10 Maths to understand the topic more clearly in effective way.

ML Aggarwal Solutions ICSE Maths for Class 10 Exercise -1 GST

Question -1

A manufacture sells a T.V to a dealer for Rs.18000 and the dealer sells it to a consumer at a profit of Rs 1500. If the sales are intra state and the rate of G.S.T is 12 %, Find:

(i) the amount of GST paid by the dealer to the Stale Government.

(ii) the amount of GST received by the Central Government.

(iii) the amount of GST’ received by the State Government.

(iv) the amount that the consumer pays for the TV.

Answer -1

Manufacturer sells T.V to a dealer = ₹ 18000

Dealer sells it to consumer at a profit of = ₹ 1500

∴ SGST – CGST = ½ GST

As this transaction is intra-state so the dealer should pay SGST to state government and CGST to central government only on ₹ 1,500.

GST 12% = 6% CGST + 6% SGST

Amount of GST collected by manufacturer from dealer,

∴ CGST – SGST = 6% of 18000

= (6/100) × 18000

= ₹ 1080

∴ Manufacturer will pay ₹ 1080 as CGST and ₹ 1080 as SGST

Now, CP of a TV for dealer = ₹ 18000

Profit = ₹ 1500

SP of a TV for dealer to customer – CP + Profit

= ₹ 18000 + ₹ 1500

= ₹ 19500

Amount of GST collected by dealer from customer,

CGST = SGST = 6% of ₹ 19500

= (6/100) × 19500

= ₹ 1170

(i) The amount of tax paid by dealer to State Government

∴ GST collected by dealer from customer – SGST paid by manufacturer

= ₹ 1170 – ₹ 1080

= ₹ 90

(ii) The Amount of GST received by the Central Government.

∴ CGST paid by manufacturer + CGST paid by dealer

= ₹ 1080 + ₹ 90

= ₹ 1170

(iii) The Amount of GST received by the State Government.

∴ SGST paid by manufacturer + SGST paid by dealer

= ₹ 1080 + ₹ 90

= ₹ 1170

(iv) The Amount that the consumer pays for the TV.

∴ CP of TV + CGST paid by customer + SGST paid by customer

= ₹19500 + ₹1170 + ₹ 1170

= ₹ 21840

Question- 2

A shopkeeper buys a camera at a discount of 20% from a wholesaler. the printed price of the camera being Rs 1600. The shopkeeper tells It to a consumer at the printed price.

If the sales are intra-state and the rate of GST Is 12%, find:

(i) GST paid by the shopkeeper to the Central Government

(ii) GST received by the Central Government.

(iii) GST received by the State Government.

(iv) the amount at which the consumer bought the camera.

Answer -2

due to transaction is intra-state

Hence SGST = CGST = ½ GST

∴ CP of camera for shopkeeper

= printed price – Rate of Discount

= ₹1600 – 20% of ₹1600

= ₹1600 – (20/100) × 1600

= ₹1600 – ₹320

= ₹1280

rate of GST = 12%

The amount of input GST paid by the shopkeeper to the wholesaler,

CGST = SGST = 6% of ₹1280

= (6/100) × 1280

= ₹76.80

(i) The amount of output GST paid by the shopkeeper to the Central Government

CGST = SGST = 6% of ₹1600

= (6/100) × 1600

= ₹96

the amount of GST paid by the shopkeeper to the Central Government

∴ Output CGST – Input CGST

= ₹96 – ₹76.80

= ₹19.20

So, GST paid by shopkeeper of the Central Government is ₹19.20

(ii) The amount of GST received by the Central Government.

∴ The amount of CGST paid by wholesaler + the amount of CGST paid by shopkeeper

= ₹76.80 + ₹19.20

= ₹96

Therefore, the ₹96 of GST received by the Central Government.

(iii) The amount of GST received by the State Government.

∴ SGST paid by wholesaler + SGST paid by shopkeeper

= ₹76.80 + ₹19.20

= ₹96

So, the ₹96 of GST received by the State Government.

(iv) The amount at which the consumer bought the camera.

∴ The Amount paid by consumer for camera

= CP of camera + CGST paid by consumer + SGST paid by consumer

= ₹1600 + ₹96 + ₹96

= ₹1792

Question- 3

A manufacturer sells a washing machine to a wholesaler for Rs 15000. The wholesaler sells it to a trader at a profit of Rs 1200 and the trader sells it to a consumer at a profit of Rs 1800. If all the sales are intra-state and the rate of GST is 12%, find:

(i) the amount of tax (under GST) received by the State Government from the wholesaler.

(ii) the amount of tax (under GST) received by the Central Government from the trader.

(iii) the amount that the consumer pays for the machine.

Answer -3

in intra-state transaction

SGST = CGST = ½ GST

CP of washing machine for wholesaler = ₹15000

Rate of GST = 12%

∴ Amount of GST paid by wholesaler to manufacturer,

CGST = SGST = 6% of ₹15000

= (6/100) x 1500 = 900

SP of washing machine by whole seller to the trader

= CP+ Profit

= 15000+1200

=16200

The GST paid by trader to whole seller

CGST = SGST = 6% of 16200

=972 Rs

(i) The amount of tax received by the State Government from the wholesaler.

= ₹1080

Question- 4

A dealer buys an article at a discount of 30% from the wholesaler, the marked price being Rs 6000. The dealer sells it to a consumer at a discount of 10% on the marked price. If the sales are intra-state and the rate of GST is 5%. find:

(i) the amount paid by the consumer for the article.

(ii) the tax (under GST) paid by the dealer to the State Government.

(in) the amount of tax (under GST) received by the Central Government.

Answer -4

Since , it is a case of intra – state transaction of good and service.

SGST=CGST=1/2 GST;

Rate of GST=5%

The printed price of an article is Rs 50000. The wholesaler allows a discount of 10% to a shopkeeper. The shopkeeper sells the article to a consumer at 4% above the marked price. If the sales are intra-state and the rate of GST is 18%, find:

(i) the amount inclusive of tax (under GST) which the shopkeeper pays for the article.

(ii) the amount paid by the consumer for the article.

(iii) the amount of tax (under GST) paid by the shopkeeper to the Central Government.

(iv) the amount of tax (under GST) received by the State Government.

Answer -5

= 50000 -(10/100) x 5000

=50000-5000

=45000

Amount of GST paid by dealer to whole seller,

CGST = SGST = 9% of 45000

= (9/100) x 45000

= 4050

∴ Amount paid by shopkeeper for an article =

CP of an article for shopkeeper + CGST paid by consumer + SGST paid by consumer

= ₹45000 + ₹4050 + ₹4050 = ₹53100

(ii) The amount paid by the consumer for the article.

SP of an article for consumer = Marked price – Discount

= ₹50000 – 4% of ₹50000

= ₹50000 – (4/100) × 50000

= ₹50000 – 2000

= ₹48000

∴ Amount of GST paid by consumer to dealer,

CGST = SGST = 9% of ₹48000

= 9/100 × 48000

= ₹4320

∴ Amount paid by consumer for article =

CP of article for consumer + CGST paid by consumer + SGST paid by consumer

= ₹48000 + ₹4320 + ₹4320 = ₹56640

Hence, the amount paid for article by consumer is ₹56640

(iii) The amount of tax (under GST) paid by the shopkeeper to the Central Government.

₹4320 – ₹4050 = ₹270

(iv) The amount of tax (under GST) received by the State Government.

SGST paid by wholesaler + SGST paid by shopkeeper

= ₹4050 + ₹270 = ₹4320

Hence, the tax received by the State Govt. (Under GST) is ₹4320

Question 6

A retailer buys a TV from a wholesaler for Rs 40000. He marks the price of the T.V. 15% above his cost price and sells it to a consumer at 5% discount on the marked price. If the sales are intra-state and the rate of GST is 12%, find:

(i) the marked price of the TV.

(ii) the amount which the consumer pays for the TV.

(in) the amount of tax (under GST) paid by the retailer to the Central Government.

(iv) the amount of tax (under GST) received by the State Government.

Answer- 6

transaction is intra-state

SGST = CGST = ½ GST

Steps by step explanation:-

Given:

(i) The marked price of the TV.

It is given that, Retailer buy TV for ₹40000

∴ Marked price of TV = ₹40000 + 15% of 40000

= 4000 + (15/100) x 40000

= ₹ 40000 + 6000

= ₹ 46000

(ii) The amount which the consumer pays for the TV.

It is the given that, discount given by retailer = 5% of ₹46000

= (5/100) x 46000

= ₹2300

Question- 7

A shopkeeper buys an article from a manufacturer for Rs 12000 and marks up it price by 25%. The shopkeeper gives a discount of 10% on the marked up price and he gives a further off-season discount of 5% or, the balance to a customer of TV. If the sales are intra-state and the rate of CST is 12%, find:

(i) the price inclusive of tax (under GST) which the consumer pays for the TV.

(ii) the amount of tax (under GST) paid by the shopkeeper to the Stale Government.

(iii) the amount of tax (under CST) received by the Central Government.

Answer 7

transaction is intra-state

SGST = CGST = ½ GST

(i) The price inclusive of tax (under GST) which the consumer pays for the TV.

CP of an article for shopkeeper = ₹12000

Rate of mark up in price =25%

∴ M P of article = ₹12000 + 25% of ₹12000

= ₹12000 + (25/100) x 12000

= ₹15000

Rate of discount = 10%

Amount of discount given by shopkeeper = 10% of ₹15000

= (10/100) x 15000

= ₹1500

Rate of discount = 10%

Amount of discount given by shopkeeper = 10% of ₹1500

= (10/100) x 15000

= ₹1500

Rate off season discount = 5%

= 5% of (15000 – 1500)

= (5/100) x 13500

= ₹675

CP of TV for consumer = ₹13500 – ₹675 = ₹12825

Amount of GST paid by consumer = 12% of ₹12825

= (12/100) x 12825

= ₹1539

The price inclusive of tax (under GST) which the consumer pays for the TV

= ₹12825 + ₹1539 = ₹14364

(ii) The amount of tax (under GST) paid by the shopkeeper to the stale Government.

CGST = SGST = 6% of ₹12000

= (6/100) x 12825

= ₹769.50

Question 8

A manufacturer marks an article at Rs 5000, He sells it to a wholesaler at a discount of 25% on the marked price and the wholesaler sells it to a retailer at a discount of 15% on the marked price. The retailer sells it to a consumer at the marked price. if all the sales are intra-state and the rate of GST is 12%, find:

(i) the amount inclusive of tax (under GST) which the wholesaler pays for the article.

(ii) the amount inclusive of tax (under GST) which the retailer pays for the article.

(iii) the amount of tax (under GST) which the wholesaler pays to the Central Government.

(iv) the amount of tax (under GST) which the retailer pays to the State Government.

Answer 8

= (25/100) x 5000

= ₹1250

CP of article for retailer = ₹5000 – ₹750 = ₹4250

CP of article for consumer without tax = ₹5000

It is given that , Rate of GST = 12%

Amount of GST paid by wholesaler = 12% of ₹3750

= (12/100) x 3750

= ₹450

Question 9

The price of an article is Rs 40000 A wholesaler in Uttar Pradesh buys the article horn a manufacturer in Gujarat at a discount of 10% on the printed price. The wholesaler sells the article to a retailer in Himachal at 5% above the printed price. If the rate of GST on the article is 18%, find:

(i) the amount inclusive of tax (under GST) paid by the wholesaler for the article.

(ii) the amount inclusive of tax (under GST) paid by the retailer for the article.

(iii) the amount of tax (under GST) paid by the wholesaler to the Central Government

(iv) the amount of tax (under GST) received by the Central Government.

Answer 9

intra-state transaction

= (10/100) x 40000

= ₹40000

CP of article for wholesaler = ₹40000 – ₹4000 = ₹36000

:- CP of article without tax for retailer = ₹40000 + 5% of ₹40000

= ₹40000 + (5/100) x 40000

= ₹42000

(i) The amount inclusive of tax (under GST) paid by the wholesaler for the article.

= 18% of ₹36000 (As transaction is inter-state)

= (18/100) x 36000

= ₹6480

Question 10

A shopkeeper In Delhi buys an article at the printed price of Rs 24000 horn a wholesaler in Mumbai. The shopkeeper sells the article to a consumer in Delhi at a profit of 15% on the basic reel price. if the rate of GST is 12%, find:

(i) the price inclusive of tax (under GST) at which the wholesaler bought the article.

(ii) the amount which the consumer pays for the article.

(iii) the amount of tax (under GST) received by the State Government of Delhi,

(iv) the amount of tax (under GST) received by the Central Government

Answer 10

Question 11

Kiran purchases an article for Rs 5310 which includes 10% rebate on the marked price and 18% tax (under GST) on the remaining price. Find the marked price of the article.

Answer 11

Let the marked price = x

CP of an article including with tax = ₹5310

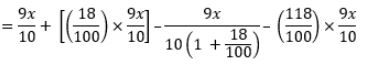

(118/100) x(9x/10) = 5310

(118/100) x(9x/10) = 5310 = 5000

= 5000 therefore marked price of an article is ₹5000

therefore marked price of an article is ₹5000Question 12

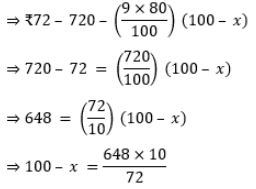

A Shopkeeper buy an article whose list price is Rs 8000 at some rate of discount from the wholesaler. He sells the article to a consumer at the list price The sales are intra-state and the rate of GST is 18%. If the shopkeeper pay a tax ( under GST) of 72 to the State Government, find the rate of discount at which he bought the article from the wholesaler.

Answer 12

MCQ, Chapter-1 GST of ML Aggarwal Solutions APC Understanding

A retailer purchases a fan for Rs 1500 from a wholesaler and sells t to a consumer at 10%profit if the sales are intra-state and the rate of GST is 12%, then choose the correct answer from the given four options for questions 1 to 6:

Question 1

The selling price of the fan by the retailer (excluding tax) is?

(a) Rs.1500

(b) Rs.1650

(c) Rs. 1848

(d) Rs. 1800

Answer 1

Question 2

(2.) The selling price of the fan including tax (under GST) by retailer is?

(a) Rs.1650

(b) Rs.1800

(c) Rs.1848

(d) Rs.1830

Answer 2

Question 3

The tax (under GST) paid by the wholesaler to the Central Government is ?

(a)Rs 90

(b)Rs 9

(c)Rs 99

(d) Rs 180

Answer

Question 4

The tax (under GST) paid by the retailer to the State Government ?

(a) Rs 99

(b) Rs 9

(c)Rs 18

(d)Rs 198

Answer 4

Question 5

The tax (under GST) received by the Central Government is ?

(a)Rs 18

(b) Rs 198

(c) Rs 90

(d)Rs 99

Answer 5

Question 6

The cost of the fan to the consumer inclusive of tax is ?

(a)Rs 1650

(b) Rs 1800

(c)Rs 1830

(4) Rs 1848

Answer 6

A shopkeeper bought a TV front a distributor at a discount of % of the listed price of Rs 32000. The shopkeeper sells the TV to a consumer at the listed price. if the sales are intra-state and the rate of GST la 18%, then choose the correct er from the given four options for questions 7 to 11:

Question 7

The selling price of the TV including tax (under GST?) by the distributor is?

(a) Rs 32000

(b) Rs 24000

(c) Rs 28320

(4) Rs 26160

Answer 7

Question 8

The tax (under GST) paid by the distributor to the State Government is

(a) Rs 4320

(b) Rs 2160

(c) Rs 2880

(d) Rs 720

Answer 8

Question 9

The tax (under GST) paid by the shopkeeper to the Central Government is?

(a)Rs 720

(b)Rs 1440

(c) Rs 2880

(4)Rs 2160

Answer 9

Question 10

The tax (under GST) received by the State Government is?

(a)Rs 5760

(b) Rs 4320

(c) Rs 1440

(d) Rs 2880

Answer 10

Question 11

The price including tax (under GST) of the TV paid by the consumer is

(a)Rs 28320

(b) Rs 37760

(c) Rs 34880

(4) Rs 32000

Answer 11

Chapter -Test of GST ML Aggarwal Solutions for ICSE Maths Class 10

Question 1

A shopkeeper, bought a washing machine at a discount of 20% front a wholesaler. the printed price of the Washing machine being Rs 18000. The shopkeeper sells it to a consumer at a discount of 10% on the printed price, it the sales are intra-state and the rate of GST is 12%, find:

(i) the price inclusive of tax (under GST) at which the shopkeeper bought the machine

(ii) the price which 1 the consumer pays for the machine.

(iii) the tax (under GST) paid by the wholesaler to the State Government

(iv) the tax (under GST) paid by the shopkeeper to the State Government

(v) the tax (under GST) received by the Central Government.

Answer 1

Question 2

A manufacturer listed the price of his good at Rs 1600 per article He allowed a discount of 25% to a wholesaler who in turn allowed a discount of 20% on the listed price to a retailer The retailer sells one article to a at a discount of 5% on the listed Price. if all the sales are intra-state and the rate of GST is 5%, find;

(i) the price per article inclusive of tax (under GST) which the Wholesaler pays.

(ii) the price per article inclusive of tax (under GST) which the retailer pay

(iii) the amount which the consumer pays for the article.

(iv) the tax (under GST) paid by the whole to the State Government for the article

(v) the tax (under GST) paid by the retailer to the Central Government for the article,

(v) the tax (under GST) received by the State Government

Answer 2

Question 3

Mukerjee purchased a movie camera for Rs 25488 which includes 10%rebate on the list price and 18% tax (under GST) on the remaining Price. Find the marked price of the camera.

Answer 3

Question 4

The Marked Price of an article is Rs 7500 A shopkeeper buys the article from a wholesaler at some discount and sells t to a consumer at the marked price. The sales are intra-state and the rate of GST is 12%. lf the shopkeeper pays Rs 90 as tax (under GST)to the State Government find;

(i) the amount of discount

(ii) the price inclusive of tax (under GST) of the article which the shopkeeper paid to the wholesaler.

Answer 4

Question 5

A retailer buys an article at a discount of 15% on the printed price front a wholesaler.He marks up the price by 10% on the printed price but due to competition in the mark. he allows a discount of 5% on the marked price to a buyer If the rate of GST is 12% and the buyer pays Rs. 468.16 for the article inclusive of tax (under GST). find

(i) the printed price of the article,

(ii) the profit Percentage of the retailer.

Answer 5

— : End of GST ML Aggarwal Solutions :–

Return to ML Aggarwal Solutions for ICSE Class-10

Thanks

Please Share with Your Friends

It is no where cleared stated to the students that whether the following are including of GST or not. It should be clarified either in the begining of chapter so that the students don’t get confused. As a matter of fact Printed price (MRP) is always by default inclusive of all taxes. In your examples GST is being additionaly calculated on the amount and not the basic price which is wrong practice.

1. List price

2. Marked Price

3. MRP (Printed Price)

Please inform us Which Question Number is wrongly Solved in GST of ML Aggarwal

So that we can update it after improving

keep in touch thanks

in default amount means CP+ tax but in case of GST related questions Amount means CP without tax untill it is mentions that with gst amount please visit icsehelp you tube chanel gst for gst concept before start viewing our solutions.

thanks